per capita tax definition

For most areas adult is defined as 18 years of age or older. Per is also sometimes used with English words.

Per Capita means by head so this tax is commonly called a head tax.

. Per se by itself of itself. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. It can apply to the average per-person income for a city region or country and is used as a means of.

Municipalities and school districts were given the. Per capita is simply another way of saying per person The phrase is most commonly used to give context to data. The per capita GDP is especially useful.

Means the adjusted net tax capacity of all taxable real property in the city or town or county divided by the total population of that city town or county. Can I confirm the balance due for my tax bill. Per curiam by the court.

The GDP of a country is calculated by dividing a countrys total domestic output by its population. Divide the income tax revenue by the taxable population. Individual Taxpayers Per Capita Tax FAQ 1.

Remember that tax revenue per capita refers to income tax that is tax levied on employment. Do I pay this tax if I rent. Define Net tax per capita.

History and Etymology for per capita. It ignores tax received on property capital gains or corporations. I did not receive my per capita tax bill.

The higher the value of a countrys per capita income it means that the society is more. Can you provide me with my invoice number so that I can make a payment online. In legal matters per capita has a very precise.

When per capita income decreases it allows national. Medieval Latin by heads. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district.

Per capita income is the mean income computed for every man woman and child in a particular group including those living in group quarters. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the.

This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Through the agency of. When comparing information between two groups it can help to break things down on a per-personor per capitabasis to ensure the comparisons are accurate.

What is per capita tax. Per capita GDP is a measure of the total output of a country that takes gross domestic product GDP and divides it by the number of people in the country. This measure is rounded to the nearest whole dollar.

By or for each individual a high per capita tax burden. Per capita by heads or according to individuals. Using the ratio explicitly an increase in PCI allows national leaders to realize their prosperity and successful economic initiatives during the year.

How to use per capita in a sentence. What is the Per Capita Tax. The formula for GDP is as follows.

The meaning of PER CAPITA is per unit of population. Can I have a copy sent to me. Post the Definition of per capita to Facebook Share the Definition of per capita on Twitter.

Income per capita is a measure of the amount of money earned per person in a certain area. So per capita income is the total income of the country divided by the total population so that the average income of the population is known. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. My billaccount information is incorrect.

It is derived by dividing the aggregate income of a particular group by the total population in that group. GDP per capita is a measurement used to determine a countrys economic output about how many people live in the country. This will give you tax revenue per capita in a given year.

Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. The main purpose of per capita income to present the average income of a nation is a great tool to manage wealth among nations. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ.

The following is a fictional example. I lost my bill. Per Capita Tax Information Definition The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

It is not dependent upon employment. Gross domestic productpopulation GDP per capita. By or for each person.

What is per capita tax calculation. Per capita income is an indicator or benchmark in measuring the level of community welfare in a country.

Information About Per Capita Taxes York Adams Tax Bureau

Property Tax Definition Property Taxes Explained Taxedu

Tax Burden By State 2022 State And Local Taxes Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

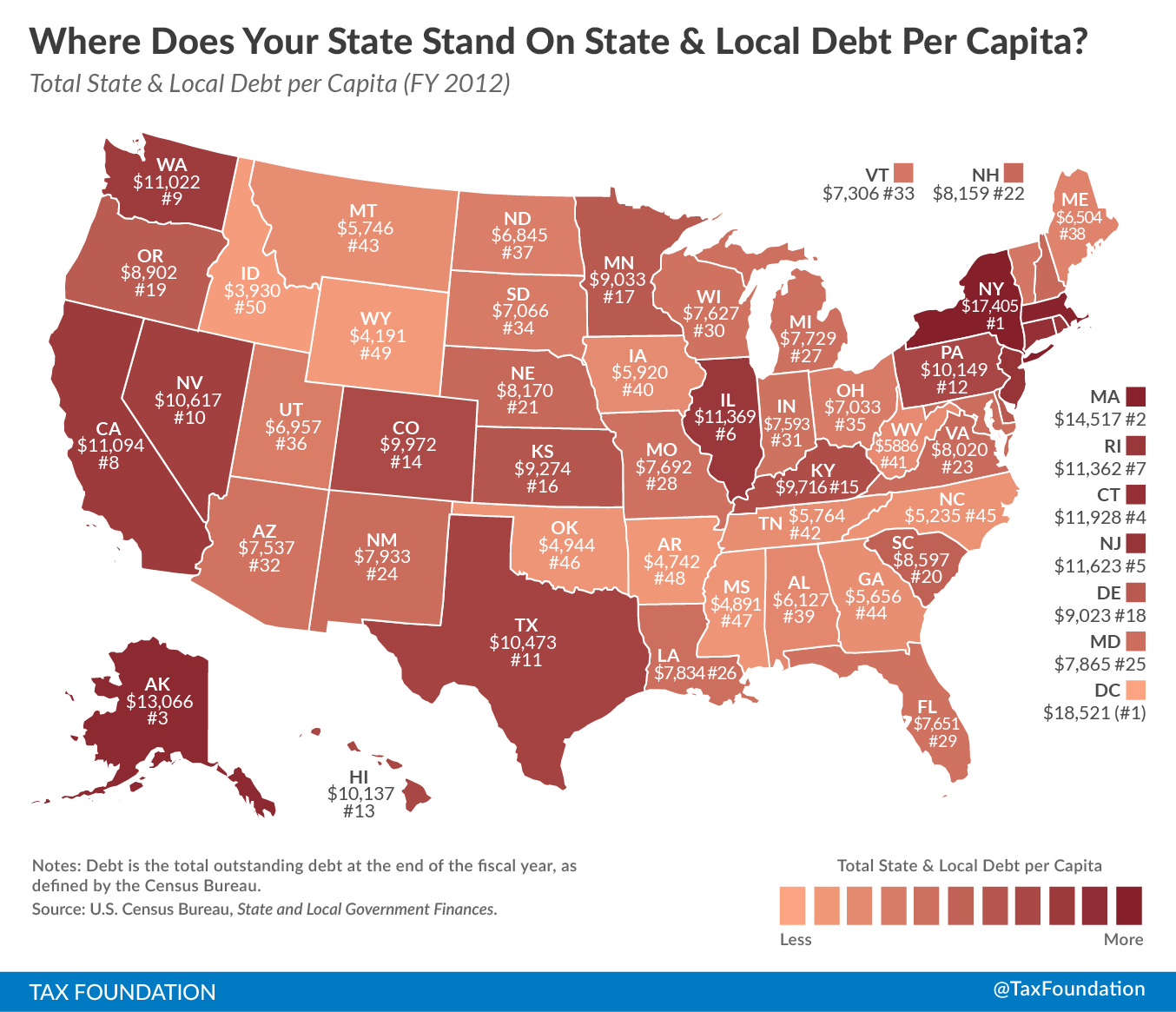

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

Usa Gdp Per Capita Constant Dollars Data Chart Theglobaleconomy Com

India National Income Per Capita 2022 Statista

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Property Tax Definition Property Taxes Explained Taxedu

Japan Gdp Per Capita Constant Dollars Data Chart Theglobaleconomy Com

Per Capita Definition Formula Examples And Limitations Boycewire

Property Tax Definition Property Taxes Explained Taxedu

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_Purchasing_Power_Parity_PPP_May_2020-01-d820977667e14964ab1b3538e0af520c.jpg)

What Is Purchasing Power Parity Ppp

Somalia Gdp Per Capita Current Dollars Data Chart Theglobaleconomy Com

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)